What is the purpose and challenge of a sustainability officer at a bank?

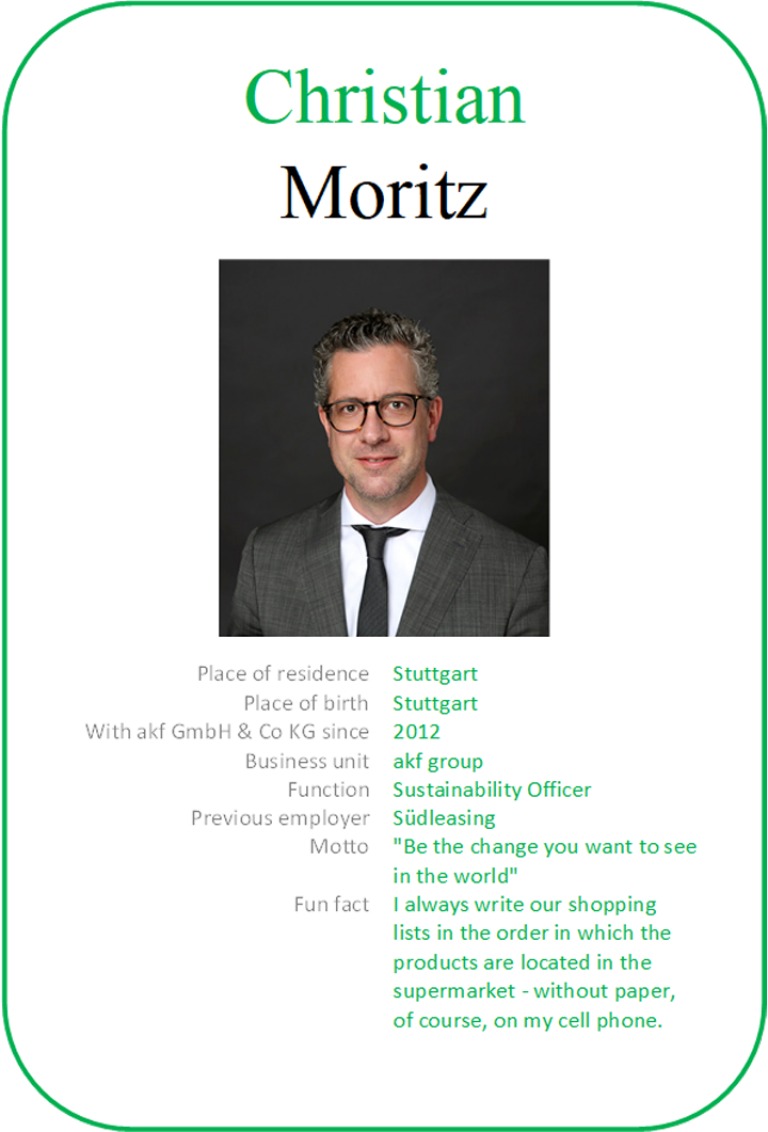

Christian Moritz, who has been fulfilling this role at akf-group since February, shares his thoughts with us in an interview. It is particularly important to him to anchor the topic of sustainability in the company and not to fool anyone with a "green coat". Only in this way can afk act as a role model and closely accompany its environment in the transformation to more sustainability, keeping the interests and resources of current and future generations in mind and taking planetary boundaries into account.

Christian, you have been the akf-group's sustainability officer since February 2022. How did your appointment come about? What made you decide to take on this position?

In the past 20 years, I have been in sales and thus in direct exchange with customers, manufacturers and dealers in various industries. My experience is that the demand for sustainable products on the market, the awareness of customers and manufacturers and their involvement with sustainability issues is constantly increasing.

The topic of sustainability is also becoming increasingly important in the financial sector and will be one of the central fields of action in the future with regard to the environment, society and corporate governance (ESG).

So it was a logical and forward-looking step for me to get involved in this topic.

The birth of my daughter 5 years ago has changed my own perspective once again. It is crucial to also keep the interests and resources of future generations in mind and to be aware of planetary boundaries.

Why is it important for akf-group to be involved in sustainability?

The need for business to act in order to contribute to the implementation of international climate goals is undisputed.

akf has been involved in sustainability for a long time and has now decided to bundle and strengthen its commitment by creating the position of sustainability officer.

Properly implemented sustainability is a decisive factor for the future viability of a bank. It is an opportunity for more growth and thus for increasing profitability.

It is important that the topic is taken seriously and that no attempt is made to pretend something with a "green coat" that is not anchored in the company's DNA. In my opinion, the resulting damage to the company's reputation is almost irreparable.

Would you say that younger people in particular are interested in sustainable banks - or does that not matter? How do you perceive that?

In terms of attracting young people, definitely; climate and environmental protection are playing an increasingly important role here. The younger generations in particular have a different awareness in this regard, and that's a very good thing.

Keeping the interests of current and future generations in mind and taking planetary boundaries into account is elementary. In my opinion, the fact that akf-group is committed to sustainability contributes significantly to its reputation as an attractive employer.

With regard to our customers, I perceive that companies that we support financially also have an interest in environmentally friendly financial concepts. We are happy to respond to this.

What are you particularly looking forward to?

The complexity of the tasks is very appealing to me. It is still too early to pick out a single project here, but I can already say that the intensive cooperation within akf and also between akf and our parent company is going very well.

Vorwerk as the parent company has many common, but also completely different sustainability topics on its agenda. Especially the differences between production company and financing company are very interesting.

Does akf-group want to appear on the market as a sustainable bank? Is that a new brand goal?

akf wants to closely accompany its customers and partners in the transformation to more sustainability.

To this end, we want to develop as a sustainable financial institution in the medium term and be perceived as such by employees, customers and market participants.

We will continuously address sustainability in all business areas and make sustainability part of the product promise.

You offer your services in many financial sectors: Auto Bank, Agribank, Industrial Finance, Marine Finance and Servicelease. That certainly presents a lot of opportunities, doesn't it?

Across the board, there are huge opportunities. The transition to a CO2-neutral economy requires structural change across all sectors. The need for new technologies will rise sharply as a result, which in turn will lead to a major opportunity for the financial sector. The EU Commission anticipates an additional investment requirement of around 180 billion euros per year in the European economic area by 2030.

And in the private sector? How do you deal with the issue of sustainability away from your desk?

I still eat a good piece of meat sometimes, but I look much more closely at where it comes from. As a family, we try to buy regionally and seasonally and value good products.

I would like to teach my daughter to pay attention to these things.

I try to leave the car at home more often and walk one way or another instead. To be honest, I don't always succeed.

The crucial thing is to think about it and reflect on your consumption. We do that every day.